45 zero coupon bond value calculator

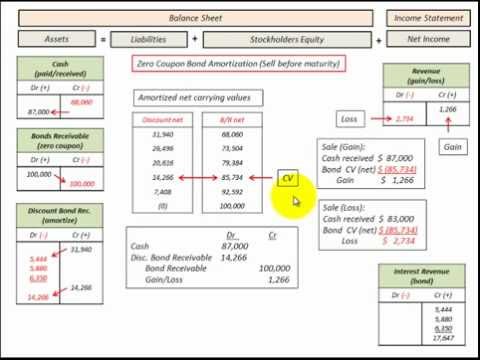

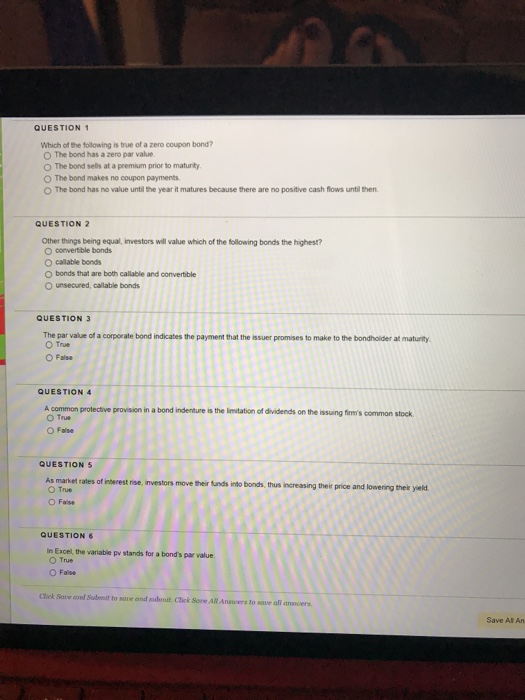

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

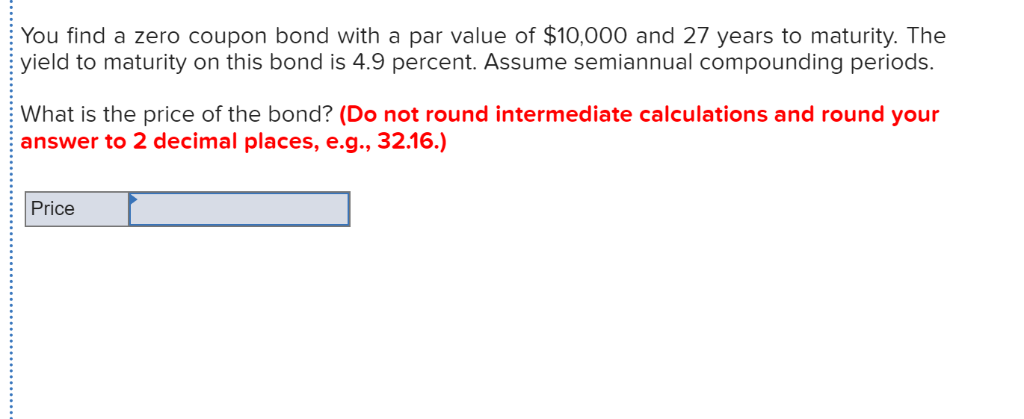

Zero Coupon Bond: Calculate the YTM (yield to maturity) Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the bond is currently trading for $459, what is the yield to maturity on this bond? Show calculations. Please show all calculations with.

Zero coupon bond value calculator

Calculate Bond Price - 7, finding yield to maturity using ... Calculate Bond Price - 15 images - pricing debt instruments, explanation bond issue price, bond formula step by step calculation of bond value with, differentiate between yield to maturity ytm and yield to, ... Zero-Coupon Bond Price. Bond Present Value Formula. Computing Bond Present Value. Yield To Maturity Formula Excel. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ... Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero coupon bond value calculator. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Bond Equivalent Yield | Formula, Example, Analysis, Conclusion The BEY is calculated as follows: Bond Equivalent Yield = Face Value−Purchase Price / Purchase Price × 365/d Link To or Reference This Page If you found this content useful in your research, please do us a great favor and use the tool below to make sure you properly reference us wherever you use it. We really appreciate your support! Calculate the present value of $1,000 zero-coupon bond ... Calculate the present value of $1,000 zero-coupon bond with 5 years to maturity if the required annual interest rate is 6%. 2-A lottery claims its grand prize is $10 million, payable over 20 years at $500,000 per year. Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ...

A zero-coupon bond with face value $1,000 and maturity of ... A zero-coupon bond with face value $1,000 and maturity of five years sells for $741.22. a. What is its yield to maturity - 23821872 Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... miniwebtool.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ... Spot Interest Rate: Meaning, Usage, Calculation, Examples The holders get the face value of the bond at maturity. To measure the rate of return that an investor will require until the maturity period, we calculate the yield for the tenure. In a way, It is actually the present value of the face value of the bond. The spot interest rate is the YTM or yield-to-maturity of such zero-coupon bonds ...

How to Calculate the Yield of a Zero Coupon Bond Using ... It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five. So we're just saying 1.07 corresponds to 7% , 1.068 corresponds to the 6.8% , 1.0624 forward rate three, 1,064 for forward rate four, and then 1.067 corresponds to the 6.7% interest for forward rate five. Value of a Bond and its Credit Spread - CFA, FRM, and ... Calculate the credit spread of the bond using YTM. Work out the credit spread, where credit spread = YTM of the risky bond - Benchmark YTM. Example 1: Zero-volatility Benchmark Rates Consider a four-year zero-coupon corporate bond with a par value of $1,000 and a flat government bond yield curve at 5%. Focus on bond and stock valuation problems and questions ... Bond Val 3) Here is a bond valuation practice problem for a zero coupon bond: What is the price of a zero coupon bond that matures in 14 years and the market rate of interest of 6.4 percent. The correct answer is $413.97 … determined below. Assume semi-annual compounding. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) ... › Finance › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon ...

Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03) 20 = $553,675.75. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert ...

How can I calculate the present value of a bond using YTM ... 1 First as already mentioned in the other answer the second formula for yield to maturity (YTM) works only for zero coupon bond. For a non-zero coupon bond YTM would be given by solving the first formula for YTM (r).

Arbitrage Free Value - CFA, FRM, and Actuarial Exams Study ... Arbitrage-Free Valuation of an Option-Free, Fixed-Rate Coupon Bond. An arbitrage-free value is the present value of expected future values using Treasury spot rates for option-free bonds. Arbitrage-free valuation usually involves three main steps: Step 1: Estimate the future cash flows. Step 2: Determine the appropriate discount rates that should

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Solved Yields: On April 1, 2022, the prices of 1-year ... Transcribed image text: Yields: On April 1, 2022, the prices of 1-year, 2-year, and 3-year zero coupon US Treasury bonds with face value 100 were, respectively, 98.2318, 95.1814, and 92.5887 (a) Calculate the yields, in percent terms, of the three bonds. (b) Using the expectations theory of the yield curve, find the expected one-year in- terest rates between years 1 and 2 and between years 2 ...

Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

Financial Calculator Zero Coupon Bond - How To Calculate ... The company may opt to buy back bonds when interest rates fall, so they can reissue the bond at lower rates. This tool calculates the market price of a zero coupon bond of a certain duration. Enter par or face value and duration to see price, and learn the formula. The annual percentage rate (apr) reflects the t.

[Solved] Bond A is zero-coupon bond paying $100 one year from now. Bond B is a zero-coupon bond ...

What Is the Coupon Rate of a Bond? Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Using a spreadsheet to calculate yield to maturity | Eagle ... Bank 2 has assets composed solely of a 7-year, 12 percent, zero-coupon bond with a current value of $894,006.20 and a maturity value of $1,976,362.88. It is financed by a 10-year, 8.275 percent coupon, $1,000,000 face value CD with a yield to maturity of 10 percent. All securities except the zero-coupon bond pay interest annually.

Zero Coupon Bonds: Calculating Price, Interest, and Value 1) You purchased a zero-coupon bond that has a face value of $1,000, five years to maturity and a yield to maturity of 7.3%. It is one year later and similar bonds are offering a yield to maturity of 8.1%. You will sell the bond.

How to Calculate the Yield of a Zero Coupon Bond? So this is basically we take the investment of $95,238 we multiply it by (1 + the Rate of Return) and that's going to give us what we get which is $100,000. Solve: So we're trying to solve for the yield you can go ahead and just divide $100,000 by $95,238.

› calculators › bondpresentvalueBond Present Value Calculator - buyupside.com Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Bond Value Calculator - Scholar Writers The bonds may be issued by the corporation at par value, at a discount or at a premium. Multiply the carrying value of the bond at the beginning of the period by the effective-interest rate to calculate the bond interest expense. From the above, example, carrying value of a bond the total par value of the common stock is $30,000 ($3 × 10,000 ...

Post a Comment for "45 zero coupon bond value calculator"