45 coupon value of a bond

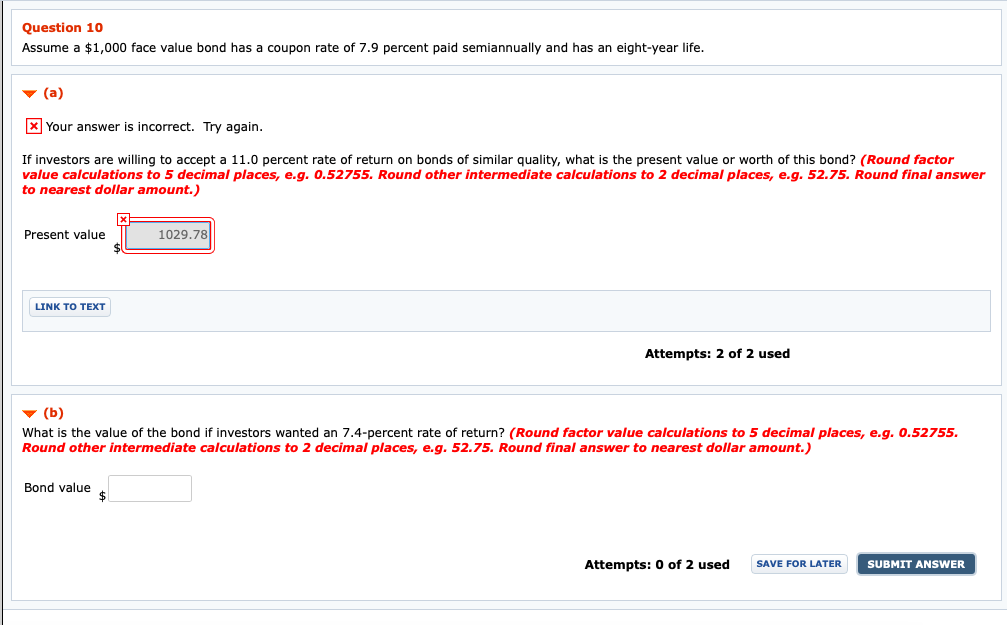

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The par value of the bond is $1,000, coupon rate of 6%, and a number of years until maturity in 6 years. Determine the price of the CB if the yield to maturity is 7%. Solution: Given,Par value, P = $1,000; Yield to maturity, YTM = 7%; Since the coupon is paid semi-annually, What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Coupon value of a bond

[Solved] A threeyear bond with 10 coupon rate and 1000 face value ... Share free summaries, lecture notes, exam prep and more!! Present value - Wikipedia Finally, if the coupon rate is greater than the market interest rate, the purchase price will be greater than the bond's face value, and the bond is said to have been sold 'at a premium', or above par. Technical details. Present value is additive. The present value of a bundle of cash flows is the sum of Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

Coupon value of a bond. Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05 Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Coupon Bond: Definition, How They Work, Example, and Use Today Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This... Publication 550 (2021), Investment Income and Expenses ... If you cash the bond when it reaches a value of $1,000, you report $500 interest income—the difference between the value of $1,000 and the original cost of $500. Example 2. If, in Example 1 , the executor had chosen to include the $200 accrued interest in your uncle's final return, you would report only $300 as interest when you cashed the ...

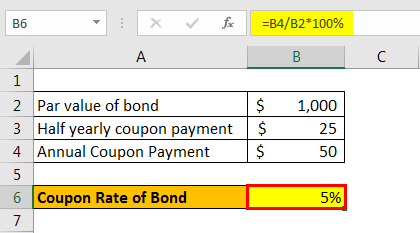

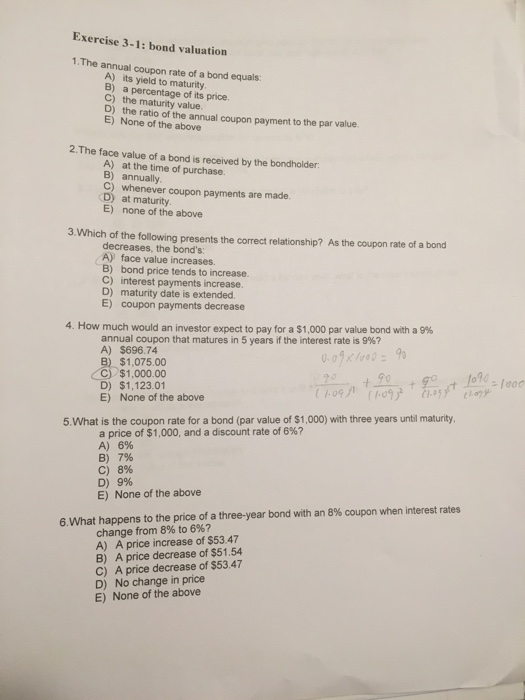

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,...

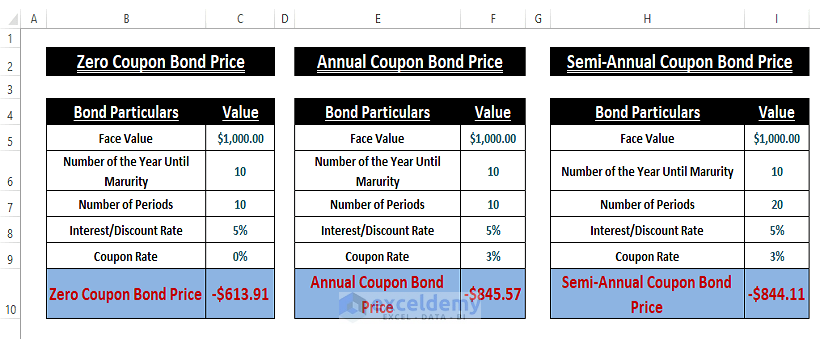

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Answered: An 8 year par value bond with… | bartleby An 8 year par value bond with semiannual coupons at 6% convertible semiannual has a price of 1050. The bond can be called at par value of X on any coupon date starting at the end of year 6. The price guarantees that Sue will receive a yield of at least 5% convertible semiannually. Calculate X. 30% annual coupons and matures at nar. Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Calculation of the Value of Bonds (With Formula) - Your Article Library Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390)

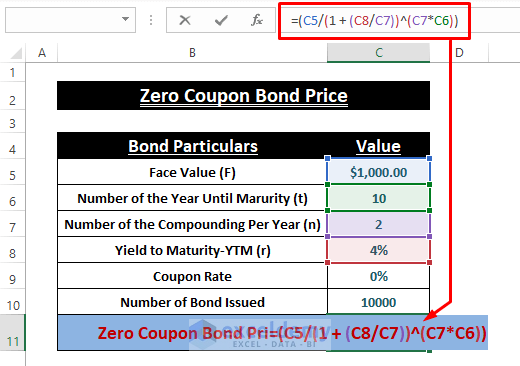

Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%. Every year, the bond will pay you 5% of its value, or $5, until it expires in a decade. That active payment occurs on a fixed basis, usually twice a year. Historically, when investors purchased a bond they would receive a sheet of paper coupons.

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

Present value - Wikipedia Finally, if the coupon rate is greater than the market interest rate, the purchase price will be greater than the bond's face value, and the bond is said to have been sold 'at a premium', or above par. Technical details. Present value is additive. The present value of a bundle of cash flows is the sum of

[Solved] A threeyear bond with 10 coupon rate and 1000 face value ... Share free summaries, lecture notes, exam prep and more!!

Post a Comment for "45 coupon value of a bond"