44 what does coupon rate mean

Coupon Definition | Bankrate.com A coupon in the financial world is defined as the annual interest rate paid on a bond that is expressed as a percentage of its face value. This also can be referred to as a bond's coupon rate ... NHS Test and Trace: what to do if you are contacted - GOV.UK May 27, 2020 · NHS Test and Trace helps to control the rate of reproduction (R), reduce the spread of the infection and save lives. What has changed The self-isolation advice for people with coronavirus (COVID ...

Affiliate marketing - Wikipedia Affiliate marketing is a marketing arrangement in which affiliates receive a commission for each visit, signup or sale they generate for a merchant.This arrangement allows businesses to outsource part of the sales process.

What does coupon rate mean

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Frequency Definition | Law Insider Coupon Frequency definition Open Split View Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist. Sample 1

What does coupon rate mean. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What Is Coupon Rate and How Do You Calculate It? - SmartAsset b. The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. It is based on the face value of the bond at the time of issue, otherwise known as the bond's "par value" or principal.Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate this important ... Myspace Blog You're now in slide show mode. Hitting < pauses the slideshow and goes back. Hitting > pauses the slideshow and goes forward. SPACEBAR resumes the slideshow.

Outlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of Office, and 1 TB of cloud storage. Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Merriam-Webster Definition of coupon. 1 : a statement of due interest to be cut from a bearer bond when payable and presented for payment also : the interest rate of a coupon. 2 : a small piece of paper that allows one to get a service or product for free or at a lower price: such as. a : one of a series of attached tickets or certificates often to be detached ...

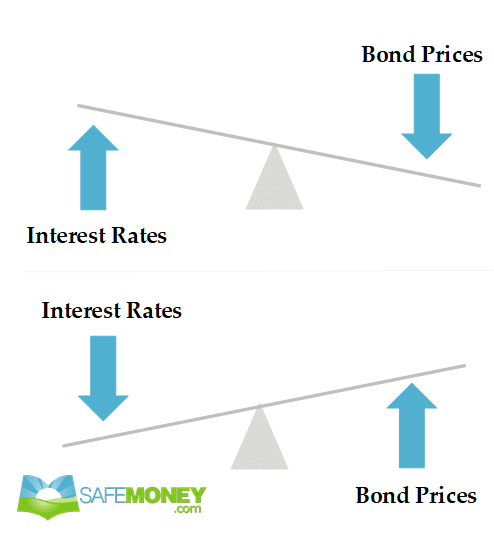

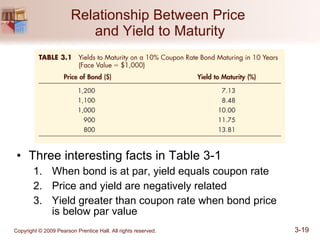

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Pop Culture: Entertainment and Celebrity News, Photos ... - TODAY Entertainment and celebrity news, interviews, photos and videos from TODAY. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The coupon is the annual payment(s) an investor can expect to receive on a bond, expressed as a percent of the par value, which is also known as the principal. Coupon payments are made at regular intervals, usually a year, though for Treasury notes for example, the interval is six months.

Archives - Los Angeles Times Nov 23, 2020 · No. The text of news articles will match in both formats, but other content can be different. For example, the digital website format does not include many print features, including weather pages ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds...

At Par - Overview, Bond Yields and Coupon Rates, Importance The coupon rate can be defined as the interest rate it yields. Par values are generally fixed at 100, in lieu of 100% of the face value of the $1,000 bond. So, when a bond is quoted or said to be trading at 100, it means that the bond is trading at 100% of its par value, which is $1,000.

What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

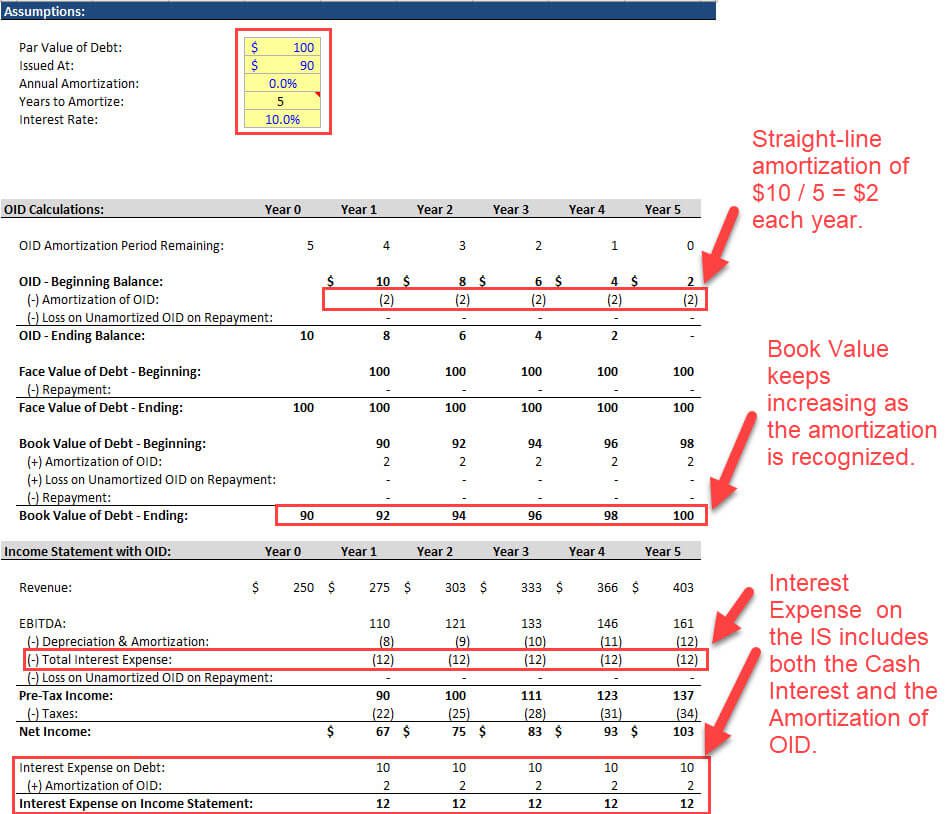

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%.

What is a Coupon? - Definition | Meaning | Example - My Accounting Course Coupon rates are set by the companies or governments that issue the bonds and can vary immensely depending on the duration of the term of the bond and/or the stability of the issuing entity. For example, a bond that has a 30-year term may have a higher rate than a 1-year note, in order to compensate the holder for having to wait longer for the ...

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also used as a way to track the steady payment ...

What does Coupon Rate mean? - YouTube Marketing Business Network 13.1K subscribers The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a brief...

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.Bonds that have higher coupon rates offer investors higher yields on their investment.

Coupon Frequency Definition | Law Insider Coupon Frequency definition Open Split View Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist. Sample 1

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![Difference Between Coupon Rate and Interest Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2022/10/Coupon-Rate-vs-Interest-Rate.jpg)

Post a Comment for "44 what does coupon rate mean"