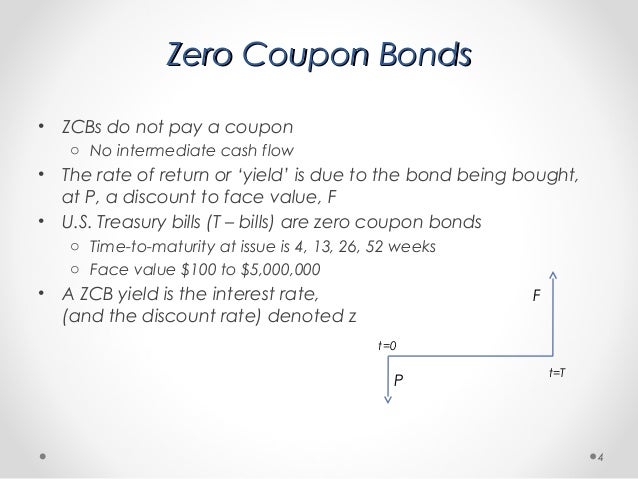

44 are treasury bills zero coupon bonds

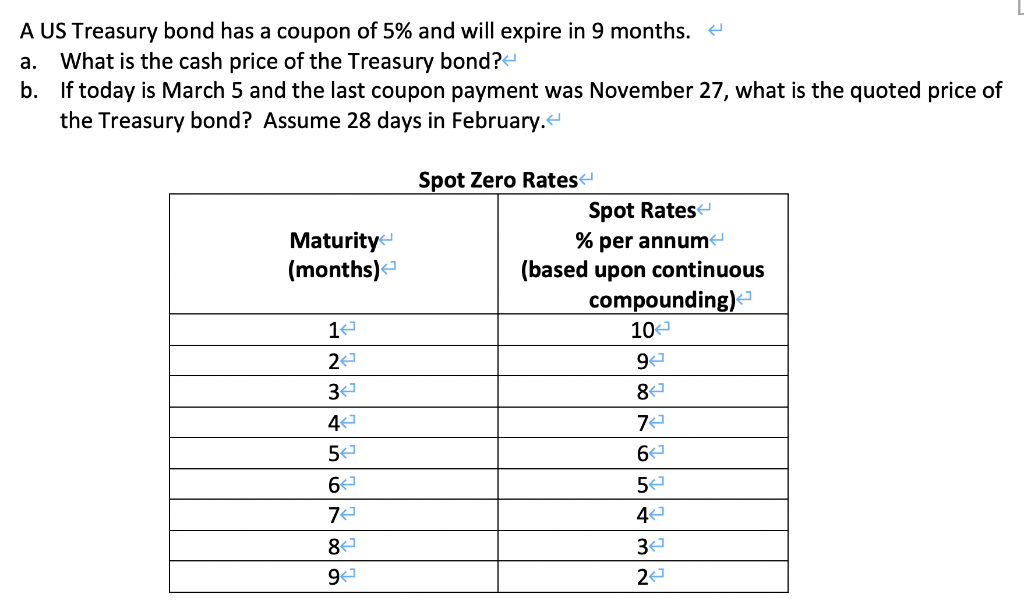

Blogger - Flight Coupons Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay ... Spot And Forward Yields - Rate Return - Do Financial Blog Would you expect the yield on a callable bond to lie above or below a yield curve fitted from noncallable bonds? 10. The six-month Treasury bill spot rate is 4%, and the one-year Treasury bill spot rate is 5%. ... In addition to the zero-coupon bond, investors also may purchase a three-year bond making annual payments of $60 with par value ...

2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity. 3.03. 3.21. 0.26. What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to ...

Are treasury bills zero coupon bonds

10-Year High Quality Market (HQM) Corporate Bond Spot Rate This is called a zero coupon bond. Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them consistent with the yields on other high quality bonds. ... U.S. Department of the Treasury, 10-Year High Quality Market (HQM) Corporate Bond Spot Rate [HQMCB10YR], retrieved from ... Domestic bonds: Greece, Bills 0% 30dec2022, EUR (182D) GR0002233022 Issue Information Domestic bonds Greece, Bills 0% 30dec2022, EUR (182D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Zero-coupon bonds, Bills. ... Treasury bills are instruments of money market with the maturity up to 1 year. Also there are 21 government bonds with the maturity up to 30 years. The level of Central ... Current Rates | Edward Jones Tax-free Bonds These are exempt from federal income tax; however, they may be subject to state and local taxes and the alternative minimum tax (AMT). For more information on these and other investments, please contact your local Edward Jones financial advisor today. Consumer Price Index Prime Rate 4.75% (effective 6/16/2022 )

Are treasury bills zero coupon bonds. Bills T Wiki treasury bills (t-bills) are zero-coupon bonds that mature in one year or less regular weekly t-bills are commonly issued with maturity dates of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks certificato di credito del tesoro (cct) - obbligazioni a tasso variabile 91 day t-bills : 3 skill-up with our 5000+ online video courses taught by … How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =... Treasury Bond Quotes | US Treasury Bond Rates | FinancialContent ... Bonds and Rates. Maturity Price Change Yield Change; US Treasury News View More Headlines. RE/MAX Belize Launch New Investment Strategy. July 15, 2022. Via PRUnderground. Topics Economy. Exposures Economy Interest Rates. MarketBeat: Week in Review 7/11 - 7/15. July 15, 2022. Via MarketBeat. Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

US2Y: U.S. 2 Year Treasury - Stock Price, Quote and News - CNBC Coupon 3.00% Maturity 2024-06-30 Latest On U.S. 2 Year Treasury Bond yields slip, yield curve inversion narrows as investors weigh Fed's next move 22 Hours AgoCNBC.com Bond yields rise as yield... Wonder Vegas Coupons No. Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but ... Long Term Government Bond ETF List - ETF Database Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years. How to Invest in Bonds: A Beginner's Guide to Buying Bonds There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ...

iShares U.S. Treasury Bond ETF | GOVT Key Facts. Net Assets of Fund as of Jul 15, 2022 $20,336,496,881. Fund Inception Feb 14, 2012. Exchange Cboe BZX formerly known as BATS. Asset Class Fixed Income. Benchmark Index ICE US Treasury Core Bond Index. Bloomberg Index Ticker IDCOTC4. Shares Outstanding as of Jul 15, 2022 849,800,000. Distribution Frequency Monthly. Domestic bonds: USA, Bills 0% 5jan2023, USD (182D) US912796X959 Zero-coupon bonds, Bills. Issue | Issuer ... It is represented by United States Treasury bonds (issued by the United States Department of the Treasury to finance government spending) and by non-marketable securities. United States Treasury securities include Treasury bills (short-term securities maturing in one year or less at par), Treasury ... Conservative Income Bond Fund - Fidelity Investments Bloomberg U.S. 3-6 Month Treasury Bills Index is the 3-6 months component of the U.S. Treasury Bills index. The Bloomberg Treasury Bill Index includes publicly issued U.S. Treasury Bills with a remaining maturity from 1 up to (but not including) 12 months. It excludes zero coupon strips.: Bills T Wiki US T-Bills use a/360 The bonds are due in 2017 and 2019 24 from 1995 until 2021, reaching an all time high of 6 Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less.

5 Year Treasury Rate - YCharts Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.05%, compared to 3.06% the previous market day and 0.78% last year. This is lower than the long term average of 3.74%. Stats

Kamakura Weekly Forecast, July 15: 2-Year 10-Year Treasury Spread ... This week's simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. There is a 28.89% probability that the 3-month yield falls in this...

Egypt's central bank issues LE 35.4B in T-bills, bonds Sunday The plan also includes offering 4 "Zero Coupon" bonds, with terms of one and a half years worth LE 29 billion, two bids worth LE 7.5 billion for three-year term, and two bids for 5-year term worth LE 2 billion. The Ministry will also offer two bids for 7-year bonds worth LE 1 billion, and two bids for 10-year bonds worth LE 500 million.

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.59%, compared to 3.64% the previous market day and 2.13% last year. This is lower than the long term average of 4.37%.

3-Month Treasury Bill Secondary Market Rate, Discount Basis Categories > Money, Banking, & Finance > Interest Rates > Treasury Bills 3-Month Treasury Bill Secondary Market Rate, Discount Basis (TB3MS) Jun 2022: 1.49 | Percent | Monthly | Updated: Jul 1, 2022

How Are Treasury Bills (T-Bills) Taxed? - Investopedia Treasury bills are short-term debt obligations that are fully backed by the faith and credit of the U.S. government. They are sold in denominations of $100 up to $5 million. T-bill maturity...

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875% Maturity 2052-05-15 Latest On U.S. 30 Year Treasury Treasury yields rise as curve remains inverted, with investors watching the Fed 20 Hours AgoCNBC.com Bond yields slip, yield curve...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.103% yield. 10 Years vs 2 Years bond spread is 28.9 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Current 5-Years Credit Default Swap ...

iShares 7-10 Year Treasury Bond ETF | IEF - BlackRock The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years.

Investing in Treasury Bills: The Safest Investment in 2022? Most bonds are usually issued with a face value of $100 or $1,000. By comparing the present value of the T-bill to its face value, an investor knows whether the bond is overvalued or undervalued. Coupon — The coupon states how much interest the bond will pay. Bonds usually pay this interest semi-annually.

How to Buy Bonds: A Step-by-Step Guide for Beginners - NerdWallet The face value of most bonds is $1,000, though there's a way around that. You have a few options on where to buy them: From a broker: You can buy bonds from an online broker — learn how to ...

Current Rates | Edward Jones Tax-free Bonds These are exempt from federal income tax; however, they may be subject to state and local taxes and the alternative minimum tax (AMT). For more information on these and other investments, please contact your local Edward Jones financial advisor today. Consumer Price Index Prime Rate 4.75% (effective 6/16/2022 )

Domestic bonds: Greece, Bills 0% 30dec2022, EUR (182D) GR0002233022 Issue Information Domestic bonds Greece, Bills 0% 30dec2022, EUR (182D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Zero-coupon bonds, Bills. ... Treasury bills are instruments of money market with the maturity up to 1 year. Also there are 21 government bonds with the maturity up to 30 years. The level of Central ...

10-Year High Quality Market (HQM) Corporate Bond Spot Rate This is called a zero coupon bond. Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them consistent with the yields on other high quality bonds. ... U.S. Department of the Treasury, 10-Year High Quality Market (HQM) Corporate Bond Spot Rate [HQMCB10YR], retrieved from ...

Post a Comment for "44 are treasury bills zero coupon bonds"