42 coupon vs zero coupon bonds

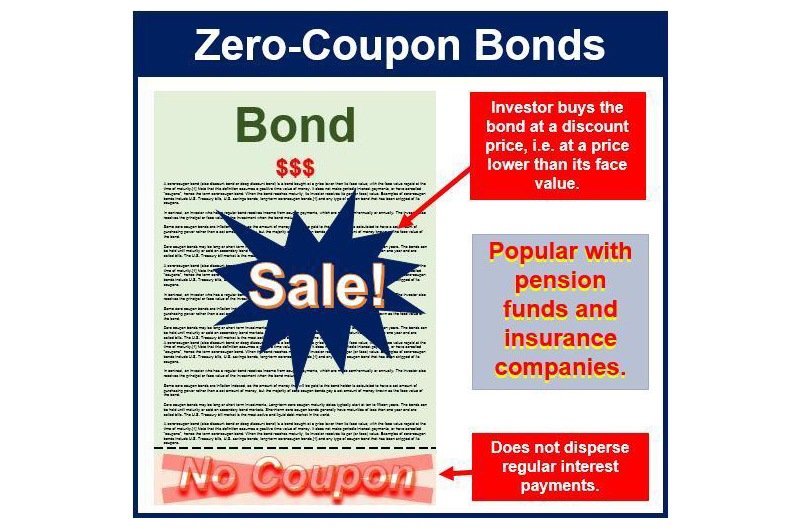

About Discount Bonds versus Zero Coupon Bonds Zero Coupon bonds are securities issued at a discount, and they have a zero coupon rate; they pay no interest. Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding ... Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially...

What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Coupon vs zero coupon bonds

Swiss Re opts for zero-coupon & multi-year notes in new Matterhorn Re ... The Class A tranche are zero coupon discount notes, which at launch were priced at 90% to 90.5% of par and these have a term to December 2022, so only covering the coming hurricane season. How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury... Numeraire: Money market vs zero coupon bond | QuantNet Community Q2: Normalized zero-coupon bond pays $1 at its maturity. Let P (t,T) denote the price of a ZC bond at time t that matures at time T. By a basic no-arbitrage argument, P (t,T) is related to the money market account via P (t, T) = E_t^Q [1/M (t,T)]. Q3: It is not that a fixed income instrument satisfies this SDE, it is simply that you could take ...

Coupon vs zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available... Fixed Vs Floating Bonds - Which is Better Investment Option? These bonds have a fixed maturity date and interest rate for the duration of the bond. As a result, fixed-rate bonds provide investors with a consistent stream of income, referred to as coupon payments. On the other hand, floating-rate bonds have a variable coupon rate that depends on the benchmark rate (repo rate or reverse repo rate). Thus ...

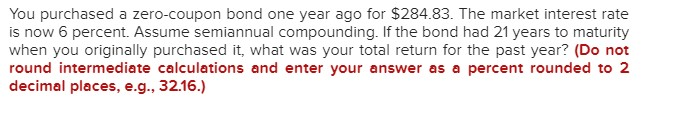

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and... 2. Below is a list of five $1,000 par value | Chegg.com Finance questions and answers. 2. Below is a list of five $1,000 par value zero-coupon bonds. Bond Years to Maturity Yield to Maturity A 1 5.00% B 2 6.00% с 7.00% D 4 8.00% E 5 9.00% 1) What is the forward 1-year interest rate four years from now? (6 marks) 2) If liquidity premiums are ignored, at what price shall bond C sell for one year from ... How to Invest in Zero-Coupon Bonds | Bonds | US News Zeros are purchased through a broker with access to the bond markets, or with an actively managed mutual fund or and index-style product like an exchange-traded fund. PIMCO 25+ Year Zero Coupon US ... Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor.Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return Zero-Coupon Bonds and Taxes - Investopedia The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not... Zero Coupon Bonds - Financial Edge Training Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. Instead, they offer investors a profit upon maturity since the purchase price of a zero coupon bond is always less than the redemption amount received at maturity.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A coupon is an interest the bond issuer pays the bondholder. Coupon payments happen periodically from the time of issuance of the bond until its maturity. A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond.

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value Some issuers may call zeros before maturity You must pay tax on interest annually even though you don't receive it until maturity Zero coupon bonds are more volatile than regular bonds

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made.

What is the difference between a zero-coupon bond and a regular ... - Quora Simple, zero coupon bonds are sold at significantly lower prices or at deep discounts- say a bond with a face value of $1000 will sell for lower than its face value say $750. So at maturity while the investor would not receive any interest, he will receive the full face value of the bond. Profit=$1000-$750=$250 (Numbers are meant purely

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured.

Numeraire: Money market vs zero coupon bond | QuantNet Community Q2: Normalized zero-coupon bond pays $1 at its maturity. Let P (t,T) denote the price of a ZC bond at time t that matures at time T. By a basic no-arbitrage argument, P (t,T) is related to the money market account via P (t, T) = E_t^Q [1/M (t,T)]. Q3: It is not that a fixed income instrument satisfies this SDE, it is simply that you could take ...

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury...

Swiss Re opts for zero-coupon & multi-year notes in new Matterhorn Re ... The Class A tranche are zero coupon discount notes, which at launch were priced at 90% to 90.5% of par and these have a term to December 2022, so only covering the coming hurricane season.

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

Post a Comment for "42 coupon vs zero coupon bonds"